Customers, regulatory agencies and governments are increasingly requiring businesses to maintain proof of authenticity, origin, work at any stage in the supply chain and social impact of raw materials.

Proof of such elements is indeed required, but shouldn’t the information thereby reported also be reliable? You are going to say that contracts protect us, but does this give us absolute trust in such protection? No, because we need to maintain proof of due diligence and confirm that the contract is respected at all times. To do so, resources are required.

Today, with the complexity and speed of the supply chain, it is becoming increasingly difficult to establish trust and transactional transparency. At the very least, trustees must make efforts to validate and verify information, a task that complicates the process.

In short, this most certainly does not constitute value creation within the supply chain, but is instead one of the costs of doing business.

The Future Belongs to Smart Contracts

When digital transformation is applied to transactional contracts, one interesting repercussion is the almost instantaneous validation of the element of trust between two parties. This presents an opportunity to optimize the back-office workflow (e.g. quality control, accounting, inventory management, purchases) or event to eliminate the trustee in the chain.

Smart contracts rely on blockchain technology. The term “blockchain” is currently fashionable in the financial technology (FinTech) industry. This popularity is partly due to the cryptocurrency Bitcoin as well as technologies such as Ripple that are designed for the instant transfer of fiat currencies between banks.

Blockchain 101

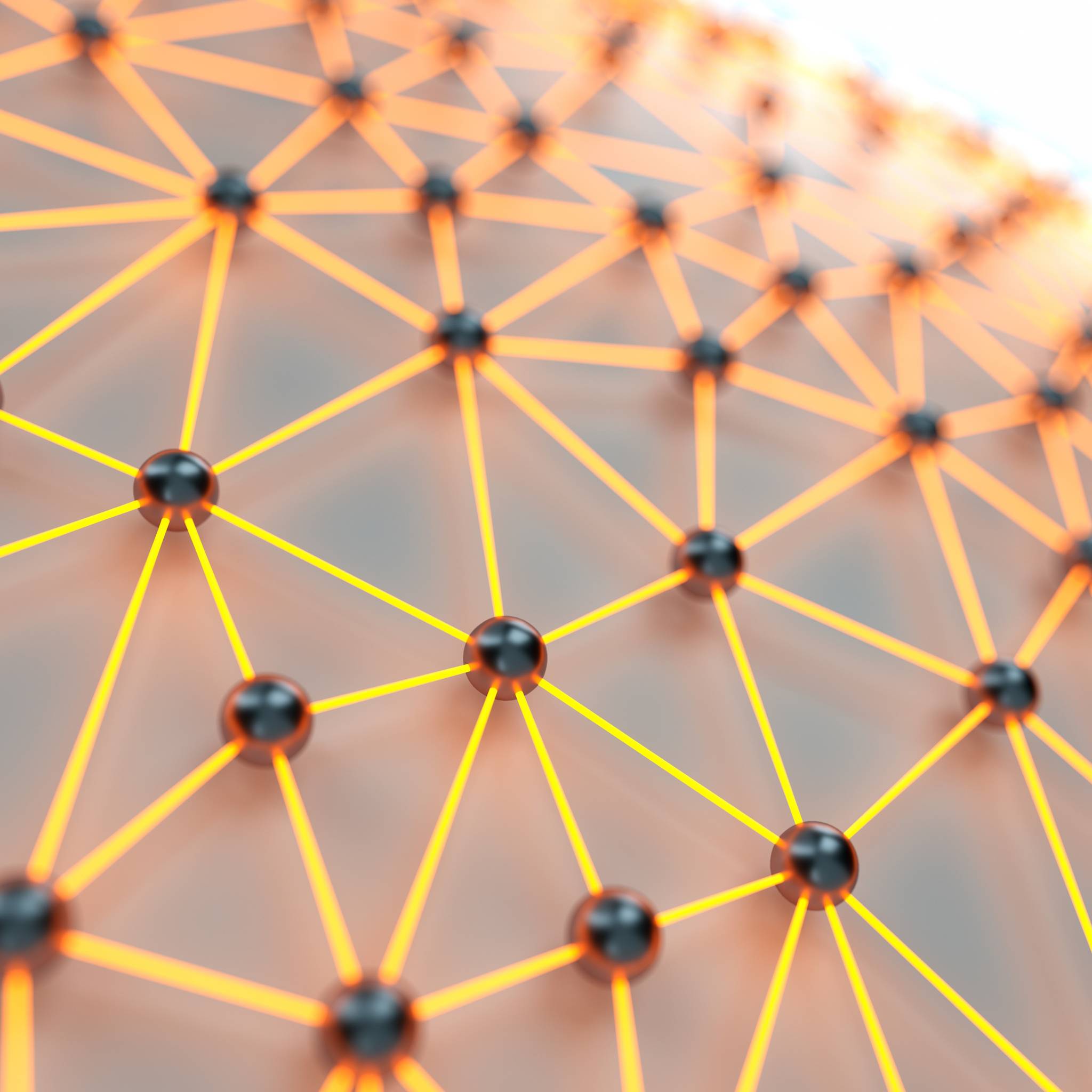

What is a “blockchain”? The term refers to a decentralized database composed of multiple storage nodes. This architecture prevents chronological blocks of exchanges from being falsified or modified. It consists of a decentralized protocol of exchange verifications. (Wikipedia, s.d.)

For example, the traceability of a product from its point of origin cannot be lost or altered. During the exchange of assets, the transaction is validated by several miners in the system such that a consensus is obtained. An anomaly inserted in a block would thus be quickly identified in the network. (Wikipedia, s.d.)